What it is and when you may need it

What it is and when you may need it

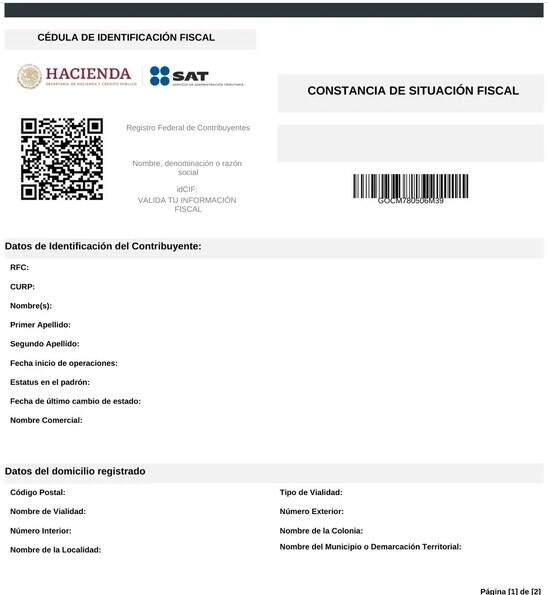

Whether you’re working, buying property, registering utilities, or issuing invoices in Mexico, obtaining a Constancia de Situación Fiscal is becoming increasingly important.

This document, issued by Mexico’s tax authority (SAT), provides a complete summary of your tax profile. It’s the official proof of your registration with SAT and is frequently requested by banks, utility companies, government agencies, and even employers to verify your legal tax status in Mexico.

What’s included in the Constancia

- RFC (Registro Federal de Contribuyentes)

- Full name or company name

- CURP (for individuals)

- Fiscal address

- Economic activities

- Tax regime and obligations

- Registration date CIF (Clave de Identificación Fiscal)

- Digital seal and issuance details

Common uses

- Opening a Mexican bank account

- Connecting services such as electricity or internet

- Selling or buying property

- Registering with IMSS or other government programs Working for a Mexican company or issuing official invoices (facturas)How to obtain it:

How to obtain it

-Online Visit www.sat.gob.mx and log in using your RFC and password or your e.firma

–SAT Móvil App – Download the SAT Móvil app and access the “Mi RFC” section

–In Person – Visit your nearest SAT office with official ID

While it’s not required for every foreign resident at all times, many people eventually need a Constancia – especially when opening a Mexican bank account, registering utilities, working with a Mexican employer, or buying property.

With more government and financial processes going digital, this document is becoming increasingly important to have on hand.

Leave a Reply